A significant Indian cryptocurrency alternate, Wazirx, has had its financial institution property of greater than $8 million frozen by the Directorate of Enforcement (ED). The alternate was supposedly acquired by Binance in 2019. Nonetheless, Binance CEO Changpeng Zhao (CZ) now claims that the acquisition was “by no means accomplished.” Wazirx, nonetheless, maintains that it was acquired by Binance.

ED’s Motion Towards Wazirx

India’s Directorate of Enforcement (ED) issued a press launch Friday regarding Wazirx, a significant crypto alternate in India. ED is a legislation enforcement and financial intelligence company of the federal government of India. The announcement particulars:

Directorate of Enforcement (ED) has performed searches on one of many administrators of M/s Zanmai Lab Pvt Ltd, which owns the favored cryptocurrency alternate Wazirx and has issued a freezing order to freeze their financial institution balances to the tune of INR 64.67 crore.

ED said that this motion is a part of its cash laundering investigation towards non-bank monetary firms (NBFC) and their fintech companions for “predatory lending practices in violation of the RBI [Reserve Bank of India] tips.”

The announcement describes: “ED discovered that enormous quantity of funds have been diverted by the fintech firms to buy crypto property after which launder them overseas. These firms and the digital property are untraceable in the intervening time.”

ED alleged that Zanmai Labs created an online of agreements with Crowdfire Inc. (USA), Binance (Cayman Island), and Zettai Pte Ltd. (Singapore) “to obscure the possession of Wazirx.” The authority additional claimed that Wazirx gave “contradictory” and “ambiguous” solutions “to evade oversight by Indian regulatory businesses,” noting that the alternate failed to offer crypto transactions of suspected fintech firms.

“Due to the non-cooperative stand of the director of Wazirx alternate, a search operation was performed,” ED pressured. “It was discovered that Mr. Sameer Mhatre, director of Wazirx, has full distant entry to the database of Wazirx, however regardless of that he’s not offering the small print of the transactions referring to the crypto property, bought from the proceeds of crime of Instantaneous Mortgage APP fraud.” The legislation enforcement company additional alleged:

The lax KYC norms, unfastened regulatory management of transactions between Wazirx & Binance, non-recording of transactions on blockchains to avoid wasting prices and non-recording of the KYC of the alternative wallets has ensured that Wazirx isn’t in a position to give any account for the lacking crypto property. It has made no efforts to hint these crypto property.

“By encouraging obscurity and having lax AML norms, it has actively assisted round 16 accused fintech firms in laundering the proceeds of crime utilizing the crypto route. Due to this fact, equal movable property to the extent of Rs. 64.67 crore [$8.14 million] mendacity with Wazirx have been frozen,” the ED announcement concludes.

Binance’s Statements on Acquisition of Wazirx

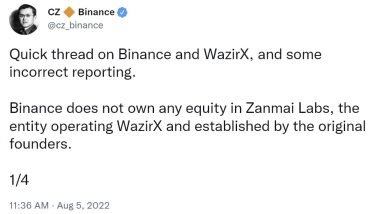

Having seen media experiences of his alternate being talked about in reference to Wazirx, Binance CEO Changpeng Zhao (CZ) stated on Twitter that his firm “doesn’t personal any fairness in Zanmai Labs.”

Zhao claimed:

On 21 Nov 2019, Binance printed a weblog put up that it had ‘acquired’ Wazirx. This transaction was by no means accomplished. Binance has by no means — at any level — owned any shares of Zanmai Labs, the entity working Wazirx.

“Binance solely supplies pockets companies for Wazirx as a tech answer. There may be additionally integration utilizing off-chain tx, to avoid wasting on community charges. Wazirx is accountable all different facets of the Wazirx alternate, together with consumer sign-up, KYC, buying and selling, and initiating withdrawals,” CZ defined.

“Latest allegations concerning the operation of Wazirx and the way the platform is managed by Zanmai Labs are of deep concern to Binance. Binance collaborates with legislation enforcement businesses all all over the world. We might be comfortable to work with ED in any means potential,” the Binance boss emphasised.

CZ’s clarification shocked many within the Indian crypto neighborhood since they have been underneath the impression that Wazirx is a Binance firm.

Clarification by Wazirx’s Founder, Binance’s Warning

In an try and make clear the connection between Wazirx and Binance, Wazirx founder Nischal Shetty insisted on Twitter that his alternate was certainly acquired by Binance.

He added that Zanmai Labs, an entity co-owned by him, has licensed from Binance to function INR-crypto buying and selling pairs on Wazirx whereas Binance operates crypto-to-crypto pairs and processes crypto withdrawals.

Asking buyers to not confuse Zanmai Labs and Wazirx, he revealed that Binance owns the Wazirx area title, has root entry to its AWS servers, has all of the crypto property, and receives all of the crypto income.

Responding to Shetty’s tweets, CZ confirmed: “We might shut down Wazirx. However we are able to’t as a result of it hurts customers.” He added that Binance doesn’t have operational management, together with “consumer sign-up, KYC, buying and selling and initiating withdrawals,” noting that they’re managed by Wazirx’s founding staff. The Binance CEO pressured: “This was by no means transferred, regardless of our requests. The deal was by no means closed. No share transfers.”

CZ additional tweeted:

When you’ve got funds on Wazirx, it’s best to switch it to Binance. Easy as that. We might disable Wazirx wallets on a tech degree, however we are able to’t/received’t do this. And as a lot debates as we’re enduring, we are able to’t/received’t harm customers.

What do you concentrate on the scenario Indian crypto alternate Wazirx is in? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.